For many folks, the name Robert Kiyosaki brings to mind ideas about money, property, and how to build up your financial standing. His most famous book, Rich Dad Poor Dad, has, you know, really made a mark on a lot of people all over the globe. It's a book that gets people thinking about how they see wealth and the way money works, often challenging common ideas about making a living and growing what you have. This particular book has, as a matter of fact, sold more than thirty million copies and has been put into many different languages, reaching out to a truly wide group of readers who are keen to pick up some insights about personal finance.

There's a lot of talk, too it's almost, about the ideas Robert Kiyosaki puts out there. Some people find his way of explaining things quite inspiring, feeling a real spark of interest when they first come across his writings. He talks a lot about owning things that bring money in, rather than things that take money out of your pocket, which is a pretty simple idea but one that can feel quite powerful. For example, he says that having your own home, which many people see as a big asset, is actually something that costs you money, a concept that can be a bit surprising for some.

Yet, as people get more familiar with his work, some feelings can shift a little. There are folks who, after initially feeling quite taken by his ideas, start to feel a bit different about certain things. This can happen when they look into some of the courses or programs that come along with his teachings, or when they just consider the practical side of what he suggests. The way he presents some of his further offerings, like workshops that come with a rather significant price tag, has, you know, made some people feel a little unsure about the whole thing.

- Travilah Elementary

- Warlocks Motorcycle Club

- Centos Madison Wisconsin

- Krells East Coast Deli

- Frankie Valli Sopranos

Table of Contents

- Robert Kiyosaki - A Brief Look at His Life

- Personal Information for Robert Kiyosaki

- Initial Sparks - What Draws People to Robert Kiyosaki's Books?

- The Shifting View - Why Do Some People Feel Hesitant About Robert Kiyosaki's Approach?

- The Cost of Learning with Robert Kiyosaki

- Assets Versus Liabilities - What Does Robert Kiyosaki Really Mean?

- The "Lazy Way" to Invest, According to Robert Kiyosaki

- Real-World Talk - Can Robert Kiyosaki's Concepts Be Seen?

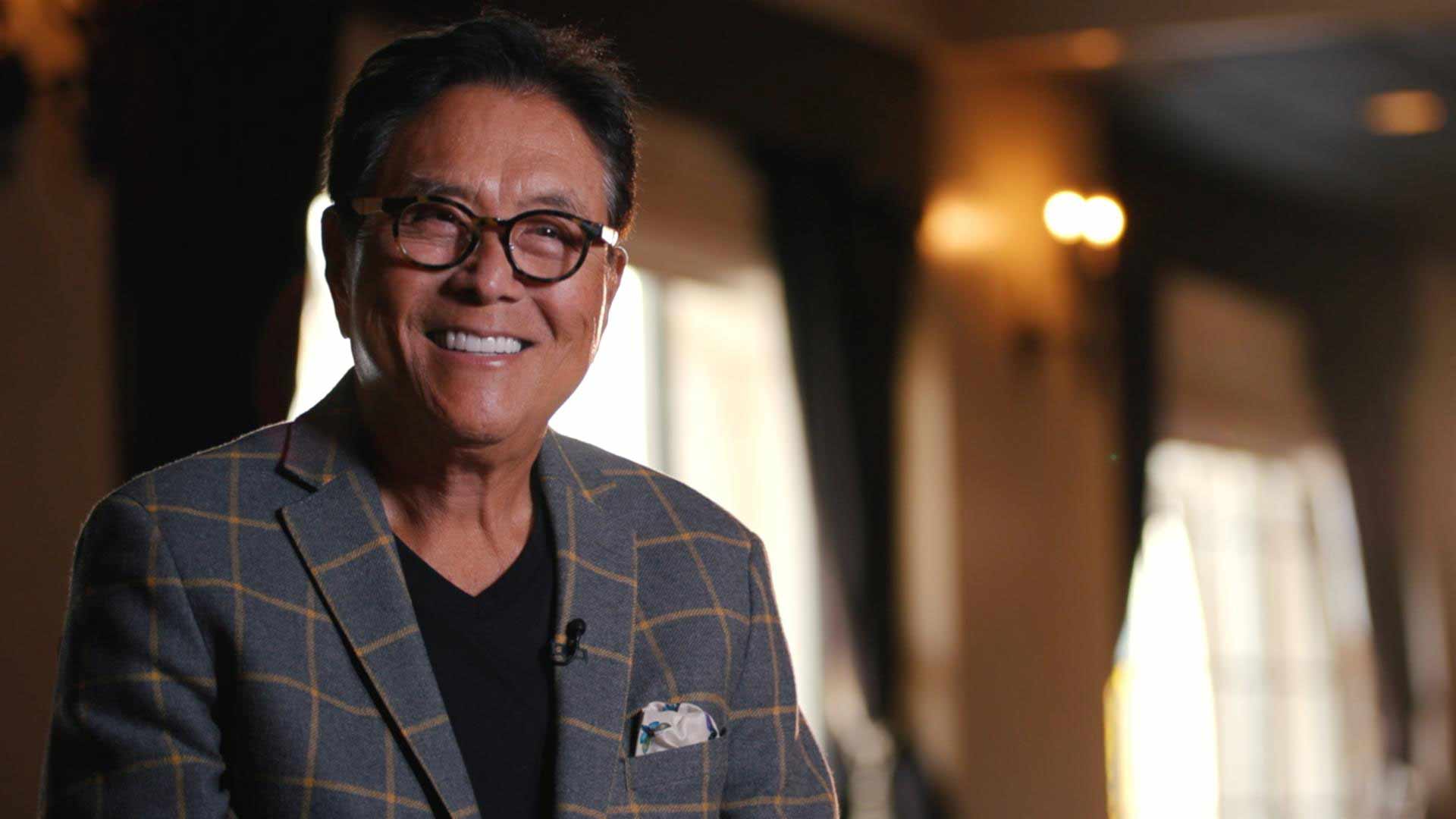

Robert Kiyosaki - A Brief Look at His Life

Robert Kiyosaki, as a matter of fact, has really become a household name for many who are interested in finance and how to make money work for them. He's known as an author, a speaker, and someone who gives advice on how to handle your personal finances. His background, you know, includes time in the military and then moving into the business world, which eventually led him to write books that have influenced many people's thoughts on money. He has, in a way, carved out a very specific place for himself in the world of financial advice, often speaking about ideas that go against what many traditional money experts might suggest.

His most well-known work, Rich Dad Poor Dad, tells a story about two different ways of looking at money, one from a "rich dad" who offers practical lessons about building wealth, and another from a "poor dad" who represents a more traditional, academic path. This storytelling style has, as I was saying, made his ideas quite easy for people to grasp, allowing them to connect with the concepts on a personal level. It's a book that many people pick up first when they start thinking about investing or changing their financial habits. He has, you know, really made a big splash with this particular book.

Personal Information for Robert Kiyosaki

| Full Name | Robert Toru Kiyosaki |

| Born | April 8, 1947 (age 77) |

| Birthplace | Hilo, Hawaii, U.S. |

| Nationality | American |

| Occupation | Businessman, Investor, Author, Motivational Speaker |

| Spouse | Kim Kiyosaki |

| Notable Works | Rich Dad Poor Dad, Cashflow Quadrant, Rich Dad's Guide to Investing |

Initial Sparks - What Draws People to Robert Kiyosaki's Books?

Many people, myself included, found themselves quite inspired and truly interested when they first picked up a book by Robert Kiyosaki, especially Rich Dad Poor Dad. There's something about his writing that, you know, just grabs your attention right from the start. He presents ideas about money and investing in a way that feels fresh and different from what you might hear elsewhere. It's like he's pulling back a curtain on how the wealthy think about making money, and that can be a really exciting thought for someone looking to improve their financial standing. The initial feeling is often one of discovery and a new way of seeing things.

He talks about owning things that put money into your pocket, rather than things that take money out, which is a pretty fundamental idea but one that isn't always taught in regular schools. This simple yet powerful concept has, in fact, resonated with millions of people who are looking for ways to build lasting wealth. For those who have read Rich Dad Poor Dad, this idea of assets versus liabilities becomes a central point of discussion. It makes you, you know, really think about every purchase differently, from a new car to, well, even your own home.

The book's popularity, selling over thirty million copies and being put into many languages, really speaks to how much it has connected with a wide audience. It has, in some respects, become a starting point for many people's financial education outside of traditional paths. This widespread reach shows that his core message, about financial independence and making your money work for you, has a very broad appeal. People are, you know, really looking for these kinds of insights.

The Shifting View - Why Do Some People Feel Hesitant About Robert Kiyosaki's Approach?

While the initial inspiration from Robert Kiyosaki's books can be quite strong, some readers, like myself, have found their feelings shifting a little as they continued to explore his work. There's a point where the initial excitement can, you know, start to mix with a bit of skepticism. This often happens when the discussion moves from the general concepts to the more specific programs or courses that are offered alongside his books. For example, there are courses like "Legacy Education" that come with a rather significant price tag, asking for something like $700 for just a three-day session. This kind of cost can make people feel, well, a little uneasy, especially when they are trying to learn about managing their money better.

It's one thing to read a book and get some broad ideas, but it's quite another to then be asked to pay a large sum for further instruction. This transition from affordable books to expensive courses can, as a matter of fact, create a feeling of being a bit put off by the whole experience. The way these programs are presented, sometimes with what feels like a very strong push to sign up, can seem a bit aggressive to some people. It makes you wonder, you know, if the focus is truly on teaching or more on selling the next level of paid content. This feeling of being a bit turned off can really stick with you.

There's also a sense, for some, that while Robert Kiyosaki talks a lot about his various "units" or investments, when you hear him speak, he often seems to stay at a very high level, discussing only broad concepts rather than specific, tangible examples. This can be a bit frustrating for those who are looking for concrete guidance. You know, it's like he talks about owning many properties, but it's hard to see the actual details of those holdings. This is a contrast, for example, to someone like Donald Trump, whose buildings you can, you know, actually go and see in the physical world. This lack of visible, real-world examples can make some people question the practical application of his ideas.

The Cost of Learning with Robert Kiyosaki

The financial side of engaging with Robert Kiyosaki's extended teachings is, you know, something that often comes up in conversations among those who have explored his work. As mentioned, there's a course called "Legacy Education" that costs $700 for a three-day period, which can be a pretty big chunk of change for many people. This kind of investment for a short course can, in fact, make a person feel a little unsure about whether it's truly worth the expense. It raises questions about the value received for the money spent, especially when the initial books are so much more accessible.

Then there's the "Cash Flow Blueprint" seminar, which I, for example, attended for an hour. This particular course is structured as five payments of $99, adding up to nearly $500. For someone just starting out or feeling a bit cautious about spending money on financial education, these kinds of costs can, you know, seem quite high. It makes you wonder if others have taken these courses and what their experiences were like, trying to figure out if there's a real benefit to be gained. There are, as a matter of fact, many theories about what might happen in the American economy, and people are looking for solid advice without feeling like they are putting too much on the line for it.

This situation can create a bit of a dilemma for those who are drawn to Robert Kiyosaki's core messages but then feel a bit hesitant about the price tag of his further offerings. It's a question of whether the additional learning truly provides enough practical information to justify the cost, or if the best value is really found in the initial books. The jump from a relatively inexpensive book to a several-hundred-dollar course can, you know, be a significant hurdle for many potential students.

Assets Versus Liabilities - What Does Robert Kiyosaki Really Mean?

A central idea that Robert Kiyosaki talks about, especially in Rich Dad Poor Dad, is the difference between assets and liabilities. He advises people to own assets, which he defines as things that put money into your pocket, rather than liabilities, which are things that take money out. This is a pretty straightforward concept, but he applies it in ways that can, you know, really make you stop and think. For example, he says that buying your own house is a liability, not an asset, because it typically involves mortgage payments, property taxes, and upkeep costs that continuously take money from you. This idea can be a bit surprising for many people who have always been taught that owning a home is a key part of building wealth.

This perspective challenges the common belief that a home is an investment that always grows in value and contributes to your financial security. He argues that unless your home is generating income for you, it's a drain on your finances, which is, you know, a very different way of looking at things. It's about seeing money flow, whether it's coming into your pocket or leaving it. This distinction is, in fact, a cornerstone of his financial philosophy and encourages people to rethink what they consider valuable in terms of money. It really makes you, you know, reconsider your personal spending habits.

So, for those of you who've read Rich Dad Poor Dad, this idea often brings up a question: if your own house is a liability, what exactly should you be putting your money into? Robert Kiyosaki suggests looking for things like rental properties, businesses that generate cash, or investments that pay you regularly. The goal is to build up a collection of items that consistently bring money in, allowing you to eventually live off those passive income streams. This focus on income-generating assets is, in a way, what sets his advice apart from more traditional financial planning that might emphasize saving and investing in retirement accounts.

The "Lazy Way" to Invest, According to Robert Kiyosaki

There's a phrase that has, you know, sometimes been associated with Robert Kiyosaki's ideas about investing, often referred to as the "lazy way to invest in real estate." This idea, as posted by an investor in Santa Barbara, CA, some years ago, suggests that there are methods to get into property ownership that don't require constant, active management. It hints at strategies that allow for more passive income, where the money comes in without you having to do a lot of ongoing work. This concept is, in fact, very appealing to many who want to build wealth but also want to have time for other things in their lives.

He talks about looking for opportunities in places where others might not, like at a bankruptcy attorney's office or on the courthouse steps. He writes in Rich Dad Poor Dad, "I began shopping at the bankruptcy attorney's office or the courthouse steps. In these shopping places, a $75,000." This snippet suggests that he looks for properties that are being sold at a discount, perhaps due to financial difficulties of the previous owners. The idea is to acquire properties for less than their market value, which, you know, immediately gives you an advantage. This approach requires a different kind of searching, one that goes beyond typical real estate listings.

This method, while potentially profitable, is not necessarily "lazy" in the sense of requiring no effort at all. It means being smart about where you look and how you buy, aiming for deals that can generate income with less hands-on work once the purchase is made. The concept is about finding ways to make your money work harder for you, rather than you working harder for your money, which is, you know, a core theme in his teachings. It's about being strategic in your acquisitions so that the property becomes an asset that truly puts money in your pocket.

Real-World Talk - Can Robert Kiyosaki's Concepts Be Seen?

One of the things that comes up when people talk about Robert Kiyosaki's teachings is the desire to see his concepts in action, in the real world. He always talks about all his "units," referring to his various properties or investments, but when you hear him speak, he often sounds like he only discusses broad ideas. This can leave some listeners wanting more specific examples, something they can, you know, point to and say, "Ah, that's what he means." It's a common feeling when learning about abstract financial ideas – people want to see how it plays out in tangible ways.

For example, some people note that at least you can go and see Donald Trump's buildings. They are physical structures that stand as a testament to his real estate activities. With Robert Kiyosaki, while his influence is undeniable and his books have sold millions, the specific details of his own real-world investments are not always as openly visible or discussed in concrete terms. This can, you know, lead to a feeling of wanting more proof or more direct examples of his financial strategies at work. It's about the difference between theoretical advice and observable results.

This isn't to say his advice isn't sound, but it does highlight a point of curiosity for many readers and listeners. They want to connect the dots between the powerful ideas in his books and actual, verifiable instances of those ideas being put into practice by him. It's a natural human desire to see how something works in practice, rather than just hearing about it in concept. This quest for tangible evidence is, you know, a pretty common part of how people learn and build trust in financial advice.

- Center Security Training Nyc

- Emily Dale

- How To Tag Someone On Instagram Comment

- Bluey Costco

- Wild Bird Fund Reviews