When folks are looking to keep up with what's happening around NVIDIA, a company many know for its chips and graphics processors, they often head to places where people gather to chat about stocks. These online hangouts, so it's almost, are where you can pick up on the collective mood, hear different viewpoints, and maybe even find some fresh ideas for your own investing thoughts. It's a bit like being in a busy market square, listening to all the conversations happening around you, trying to piece together the bigger picture.

One of the more popular spots for these kinds of chats is StockTwits, where people share quick thoughts and reactions to what's going on with companies like NVIDIA. But it's not just StockTwits; there are other online communities, you know, like Reddit, Twitter, and various finance forums where people freely share their opinions. These places offer a pretty unique window into what regular folks and even some more experienced traders are thinking about the company's prospects and recent happenings.

Finding out what investors think about NVIDIA Corporation, especially given its role as a semiconductor company that designs those impressive 3D graphics processors and software, can be quite useful. It helps to get a feel for the pulse of the market, sort of like gauging the temperature of a big crowd. You can really get a sense of the excitement, the worries, and the general direction people are leaning, which, in a way, helps paint a more complete picture of the company's standing.

- Heartland Family Dental

- Santa Maria Chrysler

- Ungovernable Beef Tallow

- Takashi Murakami Clothing

- Just Blow Little Rock Ar

Table of Contents

- What's the Chatter Around NVDA Stocktwits?

- Getting a Feel for NVDA Stocktwits Conversations

- How Do Folks Keep Up with NVIDIA's Financials?

- Looking at the Numbers Beyond NVDA Stocktwits

- Where Do People Share Thoughts on NVIDIA's News?

- Finding Updates on NVDA Stocktwits and Other Spots

- What's the Buzz About NVIDIA's Earnings?

- The Market's Reaction to NVDA Stocktwits Earnings Talk

What's the Chatter Around NVDA Stocktwits?

People looking for the latest thoughts and shared ideas about NVIDIA Corporation, often known by its ticker NVDA, tend to check out many online places. These spots are where individuals interested in the stock talk about what's going on, sharing their hopes and concerns. You'll find these discussions happening on platforms like Twitter, where quick messages fly back and forth, and of course, on StockTwits, which is really set up for these kinds of conversations about company shares. It's a pretty lively scene, with folks putting out their opinions for everyone to see.

Beyond those, Reddit has its own corners where people gather to talk about specific company shares, and Seeking Alpha offers a platform for more detailed articles and the comments that go with them. Other social media spots also host these kinds of talks, creating a wide web of shared perspectives. It's almost like a big, open forum where anyone can, you know, chip in with what they are thinking about NVIDIA's path forward or what its most recent moves might mean for its value. This collective sharing helps people get a broader sense of the general feeling out there.

The core idea behind all these places is to find out what people who put their money into the market think about NVIDIA Corporation. Since NVIDIA is a big player in making those specialized chips for graphics and other advanced tech, there's always a lot of interest in its activities. These online communities allow people to see what others are making of the company's latest products, its place in the market, or any big announcements. It's a way, you could say, to feel the pulse of the crowd and understand the various viewpoints floating around.

- Wild Bird Fund Reviews

- When Is Victorias Secret Semi Annual Sale 2025

- Victoria Secret Love Is Heavenly

- Papillion Animal Hospital

- Town Peddler

Getting a Feel for NVDA Stocktwits Conversations

When you look at places like StockTwits, specifically for NVDA, you'll see a constant flow of messages. These messages cover a wide range of topics, from simple observations about the daily ups and downs of the company's share price to deeper thoughts on what big news might mean for its future. People often share charts, their own predictions, or just a quick note about how they are feeling about the company's prospects. It's a pretty direct way to, you know, get a sense of the immediate reactions to market movements and company announcements.

Engaging in these chats with other people who trade, often called fellow traders, through what some call "NVDA minds" on StockTwits, offers a chance to exchange ideas. You can see what others are noticing, what patterns they are picking up on, or what concerns they might have. It's not just about getting information; it's also about being part of a group that shares a common interest. This collective wisdom, or at least the collective opinion, can sometimes highlight things you might have missed if you were just looking at the numbers on your own.

Beyond StockTwits, the NASDAQ:NVDA forum, for instance, is another place where many individuals who put their money into company shares gather. Here, you can look through discussions and pick up insights from, really, millions of people who are also watching NVIDIA. These forums tend to have longer, more thought-out posts compared to the quicker messages on StockTwits or Twitter. It's a good spot to, in a way, dig a little deeper into the reasoning behind people's positions and to see a broader spectrum of opinions on the company's standing.

How Do Folks Keep Up with NVIDIA's Financials?

To make smart choices about putting money into a company like NVIDIA, people really need to get a handle on its financial health. This means looking at more than just the daily movements of its share price. They seek out the most recent share quote, which tells them its current value, and also its past performance, to see how it has behaved over time. This kind of information is, you know, pretty vital for anyone trying to figure out where to place their money and how to manage their holdings.

There's a lot of essential information that helps people with their stock trading and investing decisions. This includes looking at things like the company's market capitalization, which gives you a sense of its overall size in the market. They also check out the PE ratio, which helps compare its current share price to its earnings, giving a hint about whether it might be, arguably, a good value. These figures, along with others like EBITDA and EPS, paint a fuller picture of the company's money-making ability and its financial strength.

Beyond these key financial figures, people also pay close attention to the previous closing price and the opening price for the day, as well as its highest and lowest points over the last 52 weeks. These numbers give a sense of the range of movement the company's shares have seen. The beta value is also something people look at, as it helps to understand how much the company's share price tends to move compared to the market as a whole. All these pieces of financial data, you know, come together to help someone make a more informed decision about their investment choices.

Looking at the Numbers Beyond NVDA Stocktwits

While StockTwits offers a good place for quick reactions and general sentiment, getting all the solid financial facts for NVIDIA Corporation, often just called NVDA, means looking at more formal sources. These sources provide a comprehensive view of the company's money matters. You can find everything from its overall market value, which is, basically, how much the whole company is worth in the eyes of the market, to its earnings per share, which tells you how much profit the company makes for each individual share. This kind of detailed information is pretty essential for anyone doing their homework.

These financial details include things like the company's earnings before interest, taxes, depreciation, and amortization, often shortened to EBITDA, which gives a clearer picture of its operational profitability. The price-to-earnings ratio, or PE ratio, is another figure people often check to see how expensive the shares are relative to the company's profits. Knowing the previous day's closing price and the day's opening price helps to set the context for daily trading, while the 52-week high and low show the range of its share price movements over a longer period. It's all part of understanding the company's financial story.

For those who really want to dig into the financial health of the company, looking at its beta value is also quite common. This number helps people understand how much the company's share price tends to swing compared to the broader market. If the market moves up or down by a certain amount, the beta helps predict how much NVIDIA's shares might move in response. All these pieces of information, when put together, give a very full picture of the company's financial standing, helping people make choices that are, you know, a little more grounded in hard figures.

Where Do People Share Thoughts on NVIDIA's News?

When big news comes out about NVIDIA, people are quick to share their thoughts and reactions across many online communities. They look for the latest company updates, press releases, and general headlines to understand what's happening. These news items can range from announcements about new products, changes in leadership, or even shifts in the market that might affect the company. Finding these discussions is, you know, a key part of staying informed and seeing how others are interpreting the information.

One common place to find these conversations is in forums like Yahoo Finance, where people interested in NVIDIA Corporation's shares gather to talk. These forums allow people to put forward their own views and also to gain insights from other individuals who trade shares and put their money into companies. It's a pretty active place where different perspectives are shared, sometimes leading to lively debates about the possible impacts of recent news. You can, in a way, pick up on the immediate sentiment surrounding a new piece of information.

Beyond the larger forums, smaller, more specialized communities, such as iHub's investor community, also host detailed discussions and analysis of NVIDIA Corporation's activities. These places often have people who are really focused on the company, sometimes bringing a deeper level of insight to the table. Seeing the latest talks on StockTwits about NVDA, a company known for its semiconductor and wireless chip work, is also a quick way to catch up on what people are saying about breaking news. It's all about, basically, getting a feel for the shared reaction to new information.

Finding Updates on NVDA Stocktwits and Other Spots

Staying up to date with NVIDIA's happenings means keeping an eye on various sources where news and opinions are shared. You can find corporate events, like big presentations or investor calls, and press releases that announce new products or strategic moves. These updates are, you know, pretty important for anyone trying to follow the company closely. They give a direct look at what the company itself wants to communicate to the public and to those who have invested their money.

The latest company updates and headlines are also widely discussed across different platforms. People often look to places like Yahoo Finance to view and compare NVDA, seeing how it stacks up against other companies or how its shares are performing over time. These sites often pull together a lot of information in one spot, making it easier for people to get a quick overview. It’s a good way to, basically, get a broad sense of the current state of affairs and any recent developments that might influence the company's standing.

On StockTwits, you can see the very latest conversations happening about NVDA, particularly regarding its role as a company that makes semiconductors and wireless chips. People talk about all sorts of things there, including their thoughts on its earnings reports, any news about a stock split, or even the broader market conditions that might affect its shares. It's a place where you can quickly gauge what the collective sentiment is about these important events, which is, you know, pretty useful for staying informed in real-time.

What's the Buzz About NVIDIA's Earnings?

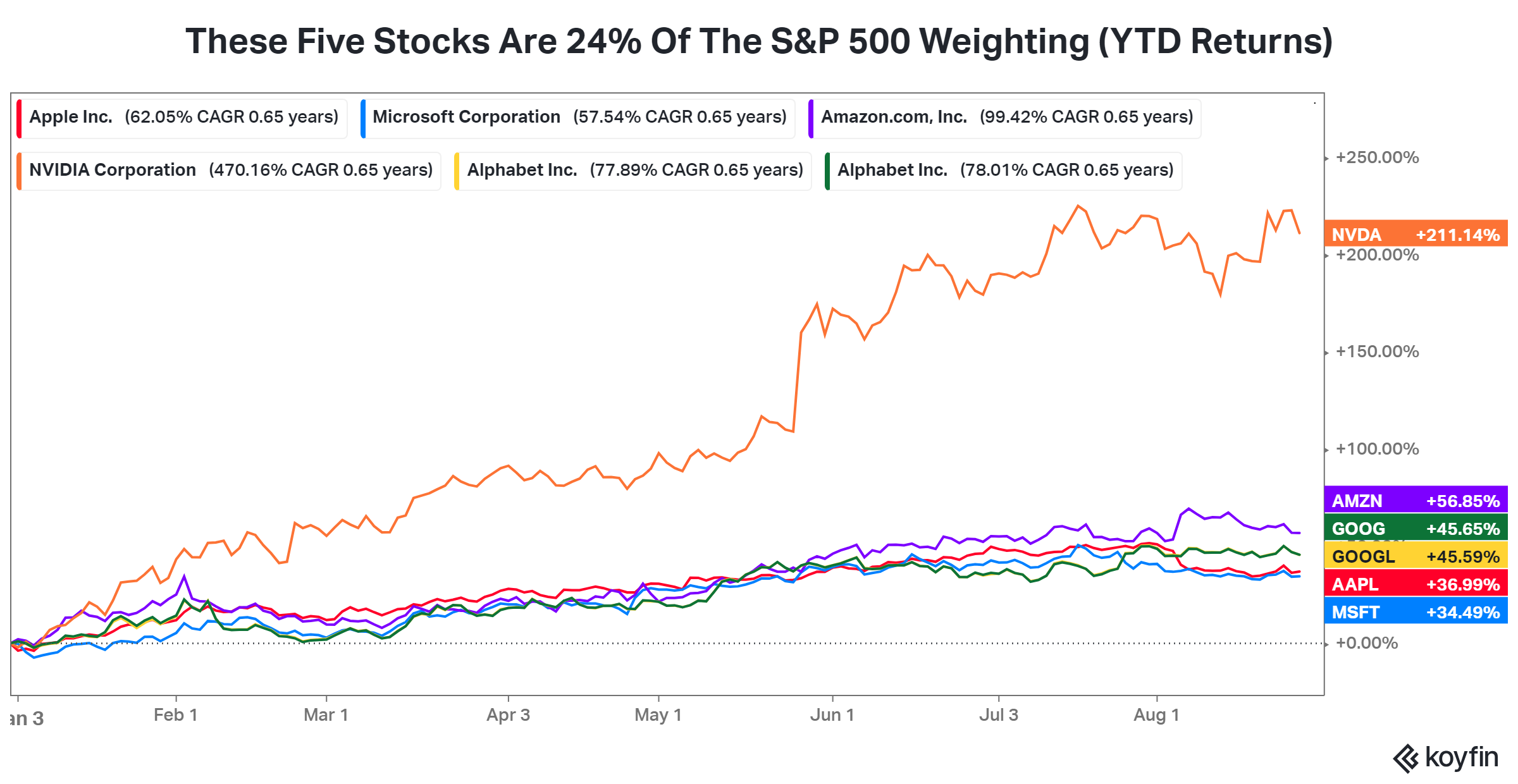

When a company like NVIDIA reports its earnings, it's a really big deal for many people who put their money into the market. These announcements tell everyone how much money the company made and spent over a certain period, and they give a clear picture of its financial health. The chipmaker NVIDIA's earnings were, you know, definitely the event many folks were looking forward to most this particular week, causing a lot of anticipation and discussion across various online communities.

The period leading up to an earnings report is often filled with speculation and predictions. People on platforms like StockTwits share their guesses about whether the company will do better or worse than expected, and what that might mean for its share price. This build-up of excitement is a pretty common pattern for big companies, as their performance can have a ripple effect across the entire market. It's almost like waiting for the results of a big game, with everyone trying to guess the score before it's announced.

And as often happens, the market did its best to, you know, make things a little confusing for both those who expected the shares to go up and those who thought they would go down after the report. Sometimes, even if a company reports good numbers, its shares might not react as expected, or vice versa. This unpredictability is part of what makes watching earnings reports so compelling for many people, as the immediate reaction can be, in a way, quite surprising and often leads to even more discussion among those watching the company.

The Market's Reaction to NVDA Stocktwits Earnings Talk

The immediate reaction to NVIDIA's earnings news can be seen almost instantly on platforms like StockTwits, where people post their thoughts as soon as the numbers come out. There was, for instance, a mention that the post "NVIDIA fails to impress" appeared first on StockTwits, suggesting an initial feeling that the company's performance didn't quite meet the high hopes of some. This kind of immediate feedback is, you know, a very direct way to see how the market, or at least a segment of it, is reacting in real-time.

The idea that "NVIDIA fails to impress" often comes after a period where the market has seen a sharp increase in share prices, or a "run," over the last few months. When shares have climbed a lot, people's expectations tend to get pretty high, so it's almost. This means that even good news might not be enough to satisfy everyone if it doesn't surpass those elevated expectations. It's a bit like a runner who's been doing incredibly well; even a strong finish might seem disappointing if it's not a new personal best.

Despite any immediate reactions, some folks keep a very positive outlook. For example, Wedbush senior analyst Dan Ives sees NVIDIA possibly reaching a very high valuation, something like four trillion dollars, by this coming summer. He has a very strong belief in the company's future, which is, you know, often described as being "uber bullish" on its shares for 2025. This kind of long-term optimism provides a different perspective from the day-to-day chatter and reminds people that there are many different ways to look at a company's prospects.

- Wild Bird Fund Reviews

- Genuine Pronunciation

- Centos Madison Wisconsin

- Anwike Breast Pump

- Naasir Cunningham